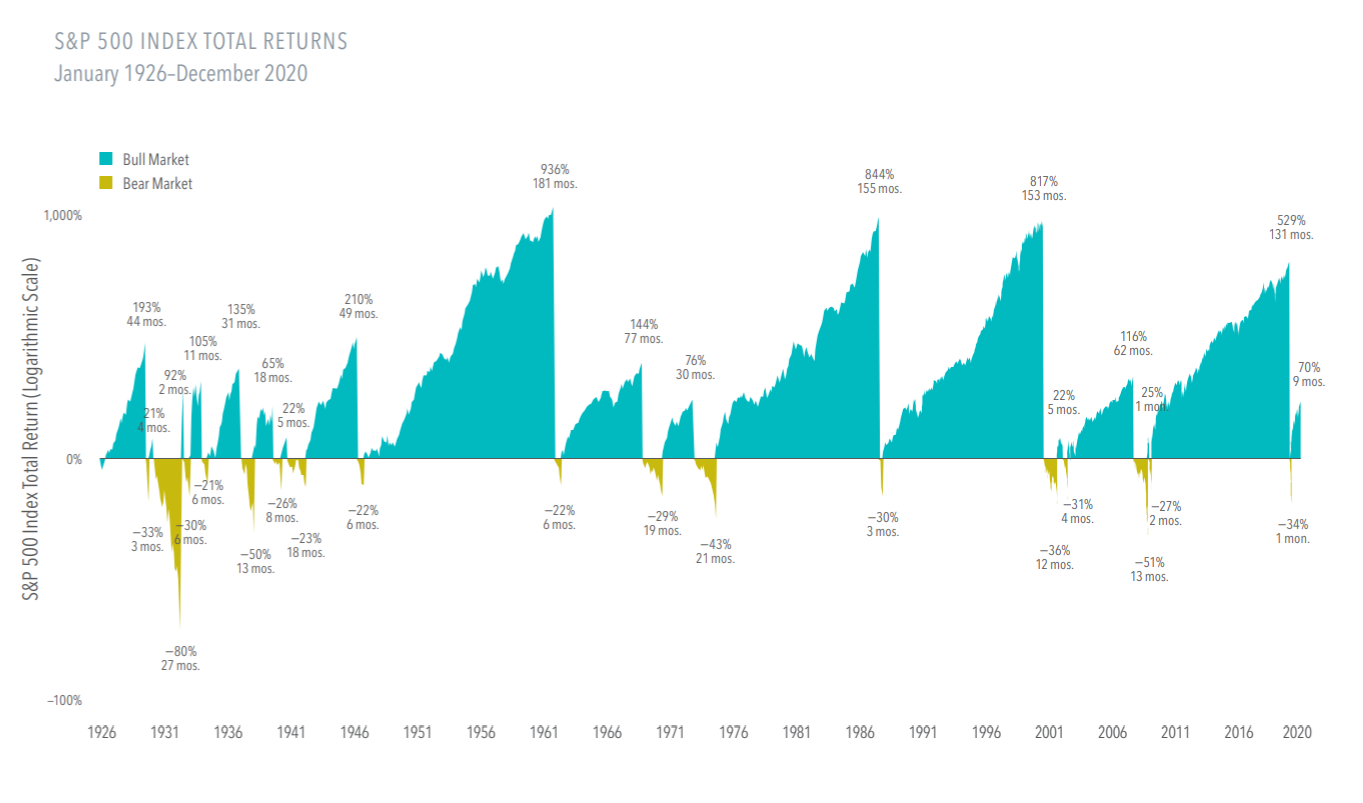

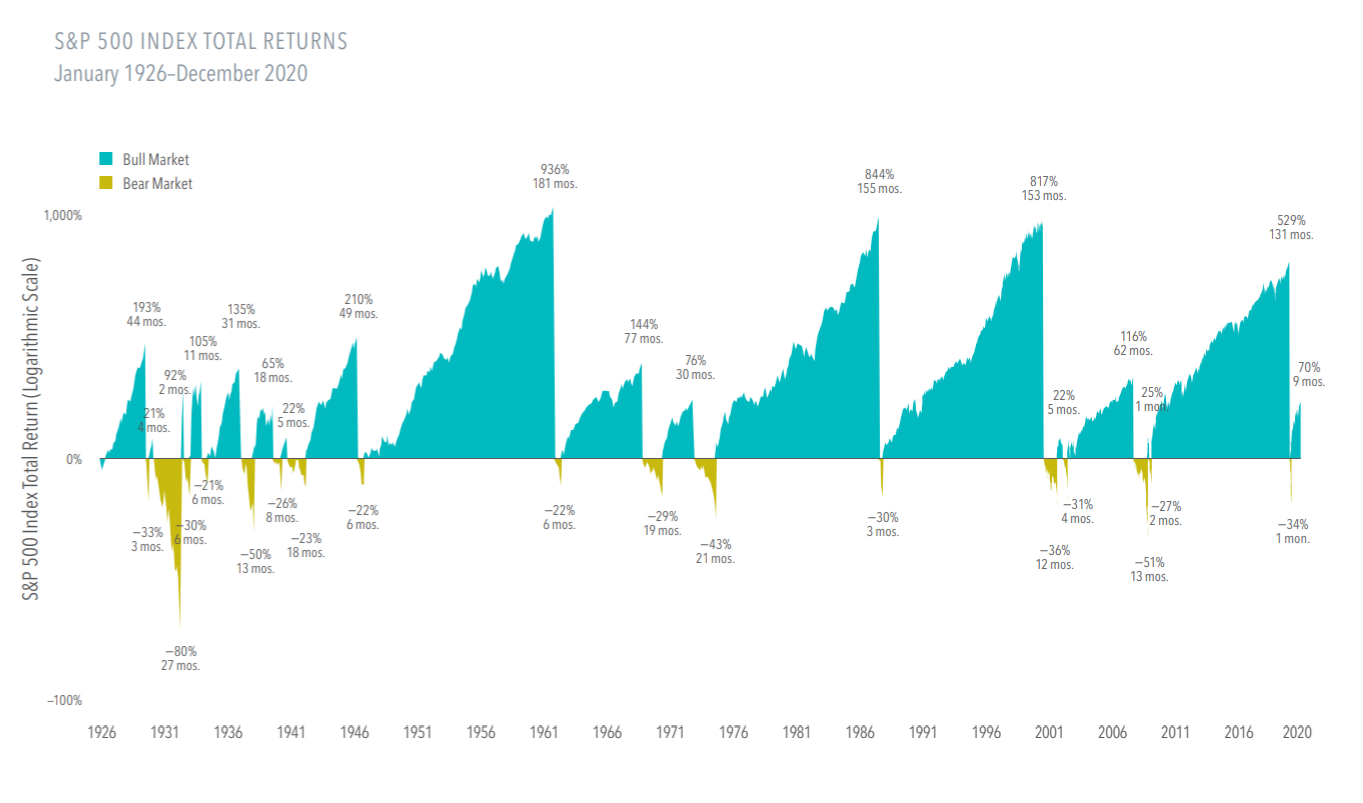

Stock returns are volatile, but nearly a century of bull and bear markets shows that the good times have outshined the bad times.

• From 1926 through 2020, the S&P 500 Index experienced 17 bear markets, or a fall of at least 20% from a previous peak. The declines ranged from —21% to —80% across an average length of around 10 months.

• On the upside, there were 18 bull markets, or gains of at least 20% from a previous trough. They averaged 54 months in length, and advances ranged from 21% to 936%.

• When the bull and bear markets are viewed together, it’s clear equities have rewarded disciplined investors

The stock market’s ups and downs are unpredictable, but history supports an expectation of

positive returns over the long term. For the best shot at the benefits the market can offer,

stay the course.

{{cta(‘f8900817-113c-4629-ba84-ae4904fab05a’)}}