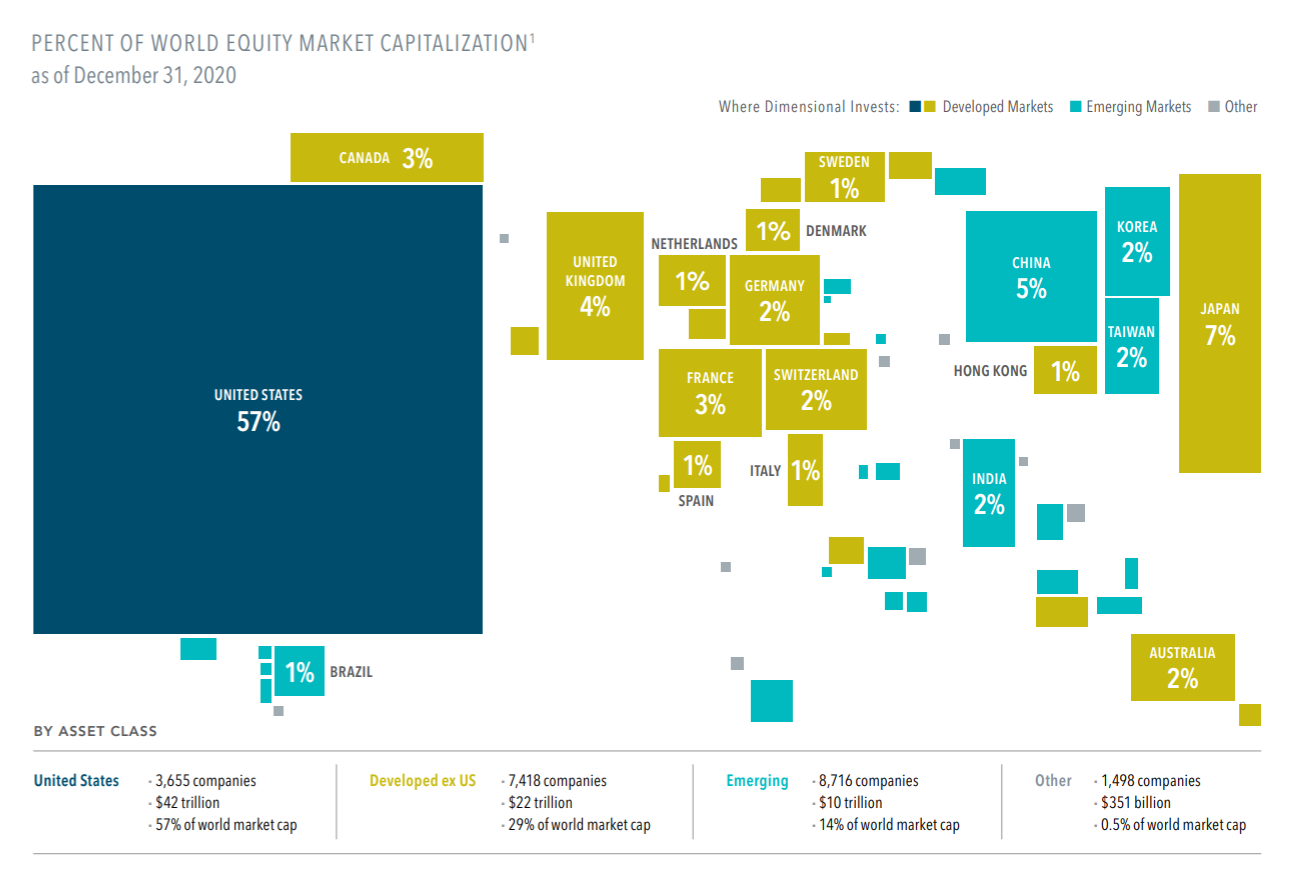

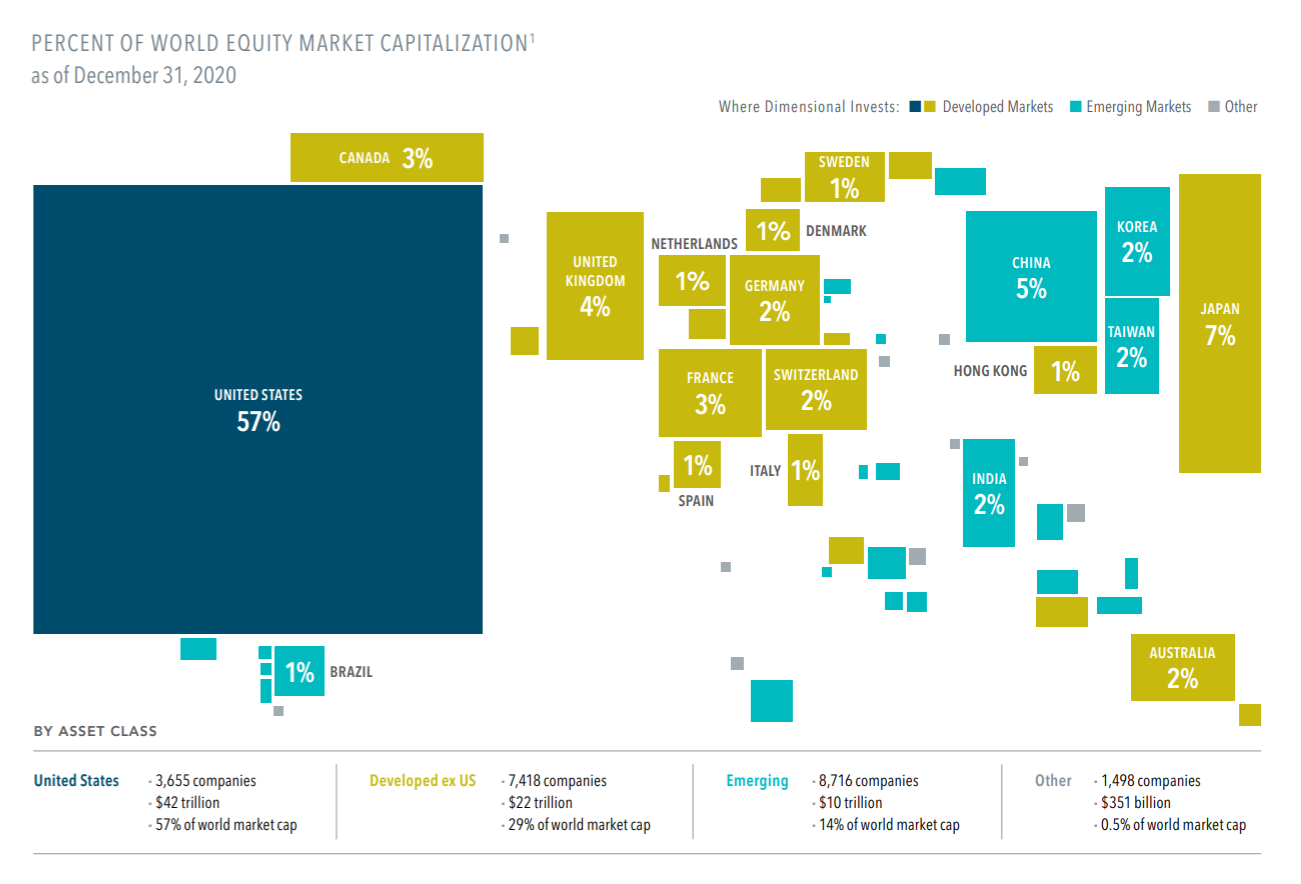

The US stock market is the biggest in the world, but investors who ignore other global markets may miss out on a wealth of opportunity.

• Stocks of the roughly 17,500 companies trading outside the US represent nearly half of the

world’s $74 trillion equity market.

• When determining where to invest, a country’s size, population, or gross domestic product

may not be a primary consideration. Japan, for instance, is relatively small in landmass but

accounts for 7% of the world’s equity market value, representing more than 2,600 companies,

including familiar names like Toyota and Sony. Even a tiny country like Switzerland is home to publicly traded giants like Nestlé and two of the world’s biggest pharmaceutical firms.

• A strategy focused on global diversification captures returns from thousands of companies

around the globe and can potentially offset weak performance in one market with stronger

returns elsewhere.

In summary, investing in multiple countries can deliver more reliable outcomes over time, helping investors stay on track toward achieving their long-term goals.

{{cta(‘f8900817-113c-4629-ba84-ae4904fab05a’,’justifycenter’)}}