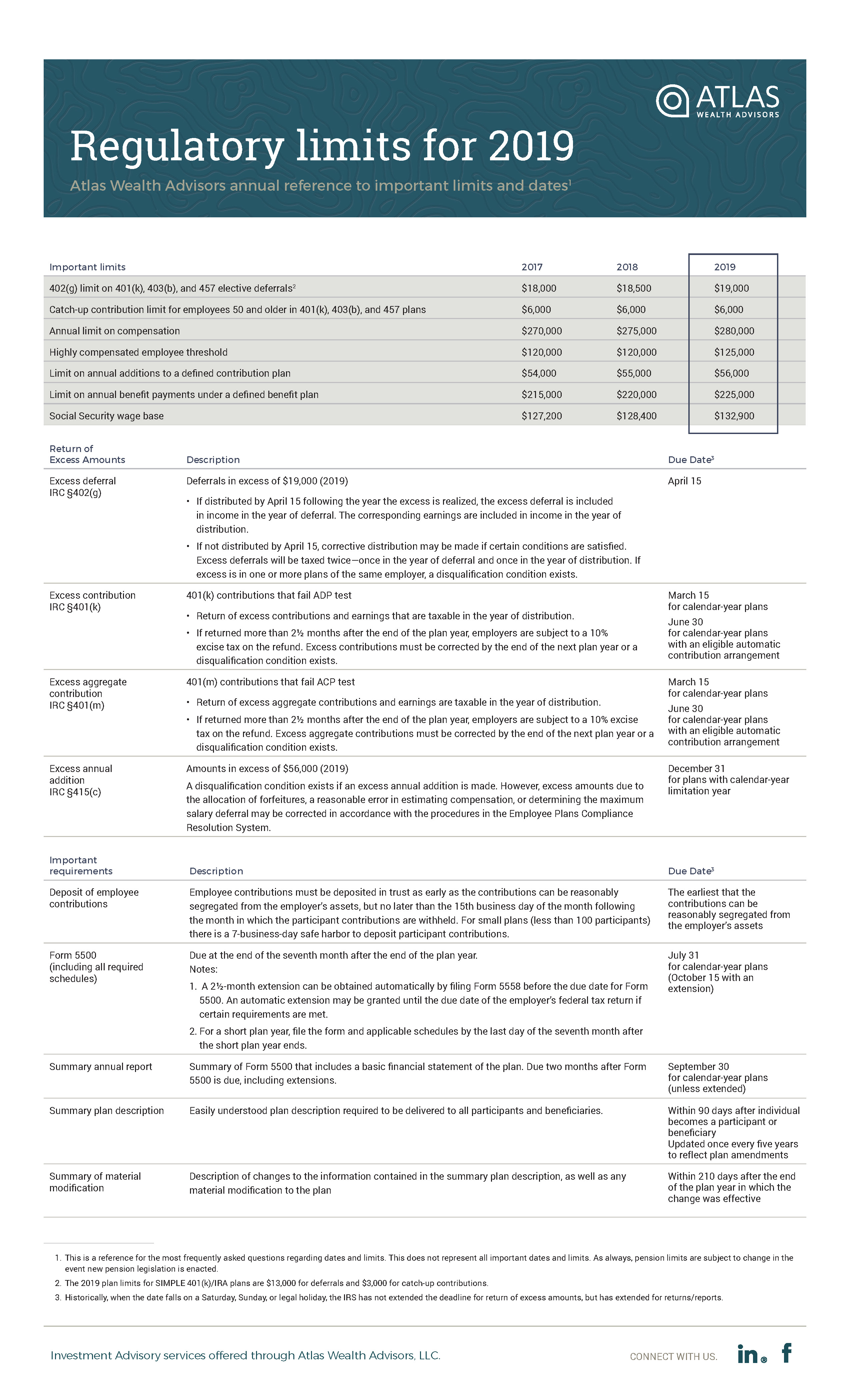

The Internal Revenue Service recently released some of its annual cost-of-living adjustments that will affect the 2019 tax year, such as contribution limits to qualified retirement plans.

Keep these important changes in mind, especially if you want to take advantage of increased contribution limits.

Questions? I’m here to help! I provide guidance and advice to both retirement plan administrators and employees to help them make better financial decisions.

{{cta(’13d7df13-be8c-48ea-a49e-1ead80e2327a’)}}